Public Hearing FY 2023-2024 Budget 2023.06.06

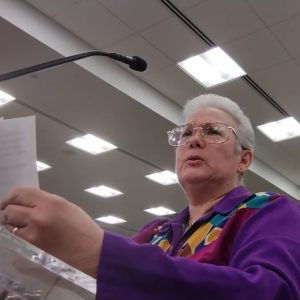

Vicki Simons spoke during a Public Hearing on the Fiscal Year 2023 – 2024 Budget before Aiken County Council (Aiken County, SC) on June 6, 2023.

Public Hearing FY 2023-2024 Budget 2023.06.06

This is the text of her speech with references that follow.

Good evening, Chairman Bunker and members of Aiken County Council.

My name is Vicki Simons. I live in Mr. Napier’s district.

What bearing do Fee in Lieu of Tax Agreements passed by Aiken County Council have on the Fiscal Year 2023 – 2024 budget?

During the May 16, 2023, Aiken County Council meeting, I informed the Council that I had submitted a Freedom of Information Act (FOIA) request in order to learn some very specific information about “Fee in Lieu of Tax” agreements that Aiken County Council has passed by majority vote over the last 10 years. (1)

I asked for:

- a list of the agreements;

- the votes cast by the Council;

- the fees that were paid; and

- a calculation of the total taxes that would have been paid by each of the project names, businesses, and other entities — from the time they came into Aiken County through Fiscal Year 2022 – 2023 — had they not paid the fee up-front.

I have received from the County Attorney enough information to be able to summarize some things for you.

From his first email:

| …the County would have all of the individual documents that are part of economic development projects, a list of which were named, and from which information would need to be gleaned and put into the format I requested. The County is not believed to have a comprehensive listing of projects, as each agreement is “a distinct economic matter for the County.” Furthermore, “the FOIA does not require a public body to create a document (such as a list or a spreadsheet) it does not have at the time of [an] FOIA request.” I understand that each entity’s potential tax payment outside a Fee in Lieu of Tax agreement would have been hypothetical and is not something the County would calculate and set forth in a record. |

From his second email:

| He reached out to the President of the Western SC Economic Development Partnership, who provided him with information. There were numerous attachments to his second email, including: a spreadsheet containing a list of 24 entities with “investments” ranging from $2.5 million to $400 million; and 9 PDF documents, for each of the years 2013 through 2021, each of which was entitled “South Carolina Department of Revenue Fee In Lieu of Tax Status Report.” For each of the Status Reports, the columns are entitled [with my notes in brackets]: |

By way of reminder, a 2022 organizational chart on AikenCountySC.gov shows that Aiken County Voters are at the top, over 5 entities, one of which is Aiken County Council. (2)

On behalf of Aiken County taxpayers who are looking at a potential tax increase this year (3), I request that Council investigate these matters in detail and report — publicly, in language everyone can understand, and before the budget vote is taken — regarding the “fee versus taxes” issue that I have raised.

Do you have any questions?

References:

1. Freedom of Information Act Request submitted by Vicki Simons

File: FOIA-request-2023.05.15.

2. 2022 Aiken County Organizational Chart

https://www.aikencountysc.gov/Reference/CountyOrgchart2022.pdf

3. “Increase in property taxes ‘very possible,’ Aiken County Council chairman says.”

Public Hearing FY 2023-2024 Budget 2023.06.06

For more information about Vicki Simons, please see our About Us page.

Please feel free to Contact Us.